So, you’ve decided to dip your toes into crypto. Maybe your cousin won’t stop talking about Bitcoin at Thanksgiving, or perhaps you’re just tired of watching your savings sit in a traditional bank account earning 0.5% interest. Whatever brought you here, welcome—you’re about to enter a world where finance meets the Wild West, but with better apps.

The first gatekeeper you’ll meet on this journey? The cryptocurrency exchange. Think of it as your on-ramp to the digital asset highway. But here’s the thing: not all exchanges are created equal, and choosing the wrong one can cost you more than just money—it can cost you peace of mind.

Let’s break down what actually matters when picking where to park your hard-earned cash (or stablecoins).

What Exactly Is a Crypto Exchange? (No Jargon, Promise)

At its simplest, a crypto exchange is a digital marketplace where you can buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, or that obscure token your friend swears is “the next big thing.”

Imagine a stock exchange, but instead of men in suits yelling on a trading floor, you’ve got algorithms, mobile apps, and 24/7 market action that never sleeps. Unlike traditional banks, these platforms operate globally, often with minimal friction between currencies.

Security is paramount when choosing where to trade—look for exchanges with robust cold storage and multi-signature wallets [1]

The Big Two: Centralized vs. Decentralized

Before we go further, you need to know there are two main flavors of exchanges:

Centralized Exchanges (CEXs) like Coinbase, Kraken, and Binance act as middlemen. They hold your funds, facilitate trades, and generally offer customer support when you accidentally send ETH to the wrong address (we’ve all been there). They’re user-friendly, regulated, and perfect for beginners—but require you to trust the company with your assets.

Decentralized Exchanges (DEXs) let you trade directly from your own wallet without a middleman. More control, more privacy, but also more responsibility. If you lose your private keys, no one can help you. For most beginners, starting with a reputable CEX is the smarter move.

What to Actually Look For (Beyond the Shiny App Interface)

1. Security That Actually Means Something

Remember 2022? The FTX collapse taught us that even the biggest names can fall if they’re playing fast and loose with customer funds. Today, the gold standard is something called Proof of Reserves (PoR).

Modern exchanges employ multiple layers of security including cold storage, encryption protocols, and regular audits [2]

Proof of Reserves is essentially an exchange showing their work—cryptographically proving they hold enough assets to cover all customer deposits. As Kraken explains, this involves independent third-party accountants taking anonymized snapshots of balances and aggregating them into a “Merkle tree” structure that users can verify themselves [12].

- No Proof of Reserves published

- History of hacks without proper compensation

- Vague answers about where funds are stored

- No insurance coverage for digital assets

Speaking of insurance, top-tier exchanges now carry crypto custody insurance covering everything from external hacks to insider theft [3][6]. If an exchange can’t tell you who their insurance provider is, that’s a conversation worth having before you deposit a dime.

2. Fees: The Silent Wealth Killer

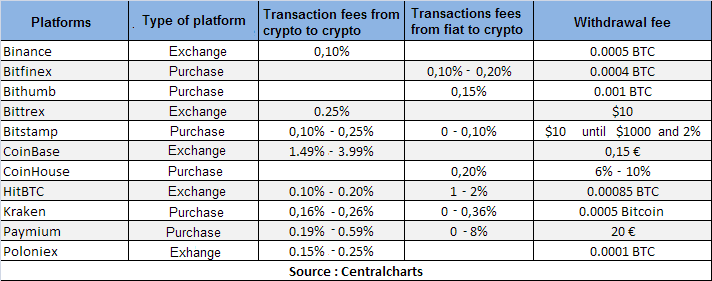

Here’s where most beginners get blindsided. That “simple” buy button on your app? It might be charging you 1.5% to 4% in hidden spreads and convenience fees. For active traders, these costs compound faster than you’d believe.

Fee structures vary dramatically between platforms—always check the maker/taker fees rather than just “instant buy” costs [5]

According to recent comparisons, here’s the rough landscape for spot trading [1][7]:

- Binance: 0.1% maker/taker (among the lowest)

- Kraken Pro: 0.16% maker / 0.26% taker

- Coinbase Advanced: 0.40% maker / 0.60% taker

- Gemini ActiveTrader: 0.20% maker / 0.40% taker

3. Availability and Regulatory Compliance

Nothing’s worse than finding the perfect exchange only to discover it doesn’t operate in your state. Gemini stands out for being available in all 50 U.S. states—a rarity in the industry [1]. Meanwhile, platforms like Crypto.com and Uphold currently skip New York due to the state’s strict BitLicense requirements.

For international users, Bitstamp (now owned by Robinhood) offers global access with over 50 licenses worldwide, making it ideal if you travel frequently or live outside the U.S. [1]

The Current Heavyweights: Who’s Winning in 2026?

For Beginners: Coinbase

The undisputed king of user experience. If you’ve never touched crypto before, Coinbase makes it almost impossible to mess up. They even joined the S&P 500 in May 2025—the first crypto exchange to achieve that milestone [1]. Downsides? Higher fees unless you subscribe to Coinbase One ($29.99/month for zero trading fees on your first $10,000).

For Low Fees: Binance

Still the liquidity king with the lowest standard trading fees (0.1%). However, regulatory issues mean Binance.US isn’t available in about a dozen states, and the interface can overwhelm newcomers [1][2].

For Security Purists: Kraken

One of the few major exchanges that’s never been hacked. Their Proof of Reserves system is considered industry-leading, and they offer robust staking options. The trade-off? A slightly steeper learning curve than Coinbase [1][7].

For Mobile-First Users: Crypto.com

With a 4.7-star App Store rating and a Visa card that lets you spend your crypto for rewards, Crypto.com nails the mobile experience. Just remember they had a $34 million hack in 2022, though they’ve since beefed up security [1][5].

Understanding Proof of Reserves: Don’t Skip This

Since the FTX collapse, Proof of Reserves has evolved from a nice-to-have to a must-have. Here’s how it actually works without the technical headache:

- The Snapshot: An independent auditor takes a cryptographic picture of all customer balances at a specific moment

- The Proof: The exchange provides digital signatures proving they control wallets containing enough assets to cover all deposits

- Your Verification: You can check that your specific balance was included in the audit using “Merkle tree” tools—fancy math that proves you’re included without revealing your identity [10][12]

Proof of Reserves has become the gold standard for exchange transparency, allowing users to verify their funds are actually held 1:1 [5]

Getting Started: Your First Week Checklist

Ready to take the plunge? Here’s your roadmap:

Verify it operates in your location. Check their insurance coverage and security track record. Look up their Proof of Reserves status.

Deposit a small amount first to test the waters. Set up two-factor authentication (use an authenticator app, not SMS). Enable withdrawal address whitelisting if available.

Practice with small trades before moving serious money. Understand the difference between “market orders” (instant but potentially higher fees) and “limit orders” (you set the price). Locate the customer support options—test them with a question.

The Bottom Line

Choosing a crypto exchange isn’t about finding the “best” one—it’s about finding the best one for you. If you value simplicity over everything, pay the premium for Coinbase. If you’re fee-sensitive and tech-savvy, Binance or Kraken Pro makes more sense. If you want to trade stocks and crypto in one place, check out Interactive Brokers [1].

Whatever you choose, never keep more on an exchange than you’re willing to lose. Use hardware wallets for long-term storage, enable every security feature offered, and remember: in crypto, if it sounds too good to be true (like guaranteed 20% returns), it absolutely is.

The wild west is becoming civilized, but it’s still the frontier. Trade safely out there.

Last updated: January 2026. Cryptocurrency investments carry significant risk; this article is for informational purposes only and not financial advice.

Quick Reference Links

- Coinbase – Best for beginners [1]

- Kraken – Best for security [7]

- Binance – Best for low fees [2]

- Gemini – Best for U.S. availability [1]

- Crypto.com – Best mobile app [1]